Archive for August, 2013

If there was any question whether the Alliance for a Better Minnesota had negatively affected him, this article is proof that ABM has changed him:

Dayton said the machinery tax repeal is the only other issue he would like discussed in the one-day session, adding that he would like to see the tax refunded retroactive to Aug. 1.

He later told farm reporters that the producer tax was in a huge budget bill and he didn’t even know it was in the legislation. “It surfaced in the last minute of the last night, and no one even wants to take responsibility for (putting it in the tax bill).”

That’s BS and Gov. Dayton knows it. Here’s how he knows he’s lying:

Rep. Hamilton asked Rep. Lenczewski whether there’d be a sales tax imposed on farm equipment repairs on the last night of the session. She confirmed that that would be one of the taxes imposed by this year’s tax bill.

Furthermore, there were heated discussions between Senate Democrats and Rep. Lenczewski over imposing this tax on farmers. Rep. Lenczewski eventually won that fight. There’s no way Gov. Dayton could’ve missed the heated discussions between Bakkk, Sen. Skoe and Rep. Lenczewski on the farm equipment repair sales tax.

The Tax Bill was the big thing for the last night of the session. Everything else was insignificant by comparison. If there was anything that Gov. Dayton and his staff were monitoring that night, it was the Tax Bill.

While it’s quite possible to believe Gov. Dayton didn’t notice it that night, it’s impossible to think his commissioners and staff didn’t notice what’d happened in the Tax Bill conference committee.

The reality is that Gov. Dayton lied at Farmfest when he said he didn’t know the farm equipment repair sales tax was in the Tax Bill. For his administration not to know what was in his signature bill this session simply isn’t credible.

Technorati: Farmfest, Farm Equipment Repair Sales Tax, Ann Lenczewski, Mark Dayton, Myron Frans, Tax Increases, Campaign Promises, DFL, Election 2014

I first wrote about President Potter’s enrollment nightmare in this post. That post was published on August 20, 2013. New figures from MnSCU have come to light that are worth examining.

In the initial post, MnSCU actual enrollment numbers said that St. Cloud State would collect $8,218,000 less in revenue than last year. As expected, that number is improving. Unfortunately for the Potter administration, the newest numbers are still pretty bleak. Based on enrollments as of August 22, 2013, St. Cloud State will collect $6,972,000 less during the 2013-14 school year than during the 2012-13 school year.

UPDATE: A faithful reader of this blog informed me that the $6,972,000 figure “is for FALL semester only” and that “it is worse than you say!” I stand corrected.

These numbers have been verified by a member of the budget committee. The person I’ve spoken with says that there’s a possibility that FYE enrollment (Full Year Equivalents) might be down by as much as 10% this year. The administration initially forecast that the FYE enrollment would be down by 2.8% to 3.2%.

When the administration first published those projections, few faculty members took the projections seriously. It’s apparent these faculty members were right about their skepticism. It isn’t a stretch to think that the faculty knew the administration’s figures were spin more than statistical projections.

It isn’t a stretch to think of the administration’s ‘projections’ as SWAG, aka a Statistical Wild Ass Guess. To be fair to SWAGers, though, it might be more accurate to simply call the Potter administration’s statistics as spin or wishful thinking.

St. Cloud State’s highest enrollment came in 2010. That year, approximately 18,300 students attended the University. That number had shrunk to approximately 15,600 last year, a decline of 14.75%. If enrollment drops another 10%, that means enrollment will have dropped by 23.5% in 4 years.

What’s worse is that St. Cloud State doesn’t have a plan to reverse the declines. Recently, they checked to see if anyone had seen any of Dr. Mahmoud Saffari’s enrollment retention proposals. When he was terminated, Provost Malhotra criticized Dr. Saffari for not having a “strategic enrollment management plan” in place:

From the October 31, 2011 letter from Provost Malhotra: “During my tenure as provost you have not produced a satisfactory strategic enrollment management plan, despite my continual counsel to you to focus on data analytics and statistical predictive models.”

It’s almost 2 years since President Potter terminated Dr. Saffari. The University still doesn’t have a “strategic enrollment management plan.” Based on MnSCU’s enrollment figures, St. Cloud State better get one in place fast before its enrollment rivals that of the biggest community colleges.

At this point, there’s nothing suggesting that the Potter administration is being honest about their enrollment projections. There’s nothing suggesting they have a plan for turning around their enrollment declines.

That’s unacceptable and this administration knows it.

Technorati: St. Cloud State, Enrollment, MnSCU, Earl Potter, Devinder Malhotra, Mahmoud Saffari

In the opening of this article, Grace-Marie Turner paraphrases Groucho Marx’s famous quote:

To paraphrase Groucho Marx: Who are you going to believe? Me, or your own eyes?

She’s talking about the building evidence that the PPACA is turning America into Part-Time Nation:

An avalanche of “anecdotes” continues to pile up as workers across the country are having their hours cut and their health benefits slashed across a broad range of industries.

Loren Goodridge, the owner of 21 Subway franchises, says he has no choice but to cut the hours of his employees to 29 a week to avoid the law’s penalties.

The negative effects of the law reach the education industry as well. St. Petersburg College, a public university in Florida, is reducing the hours of 250 faculty members because the college says it cannot afford to provide them with health insurance.

The avalanche of “anecdotal evidence” is piling up daily. In fact, it’s approaching irrefutable levels. When I wrote this post, I cited this post as a counterpoint to the White House’s spin. Here’s why I cited it:

But what really shows what is going on in America at least in 2013, is the following summary: of the 953K jobs “created” so far in 2013, only 23%, or 222K, were full-time. Part-time jobs? 731K of the 953K total.

The point is that there’s a noticeable, distinct trend in hiring. That trend isn’t likely to ebb, much less reverse:

The shift to part-time has accelerated over the past several months because of the “look back” provision in ObamaCare that sets the baseline this year for the number of full-time workers a company employs to determine their compliance with the employer pay-or-play mandate.

Sen. Baucus put it best in this now-epic speech:

This won’t end well for the administration. Forget about their spin that “there will be bumps in the road.” The PPACA is heading for a full-fledged train wreck.

Technorati: Part-Time Nation, PPACA, Train Wreck, Max Baucus, Bureau of Labor Services, Part-Time Jobs, President Obama, Democrats

The federal government is attempting to reduce gun violence by taxing law-abiding citizens through this legislation:

SEC. 4181. IMPOSITION OF TAX.

‘There is hereby imposed upon the sale by the manufacturer, producer, or importer of the following articles a tax equivalent to the specified percent of the price for which so sold:

‘(1) Articles taxable at 20 percent:

‘(A) Pistols.

‘(B) Revolvers.

‘(C) Firearms (other than pistols and revolvers).

‘(D) Any lower frame or receiver for a firearm, whether for a semiautomatic pistol, rifle, or shotgun that is designed to accommodate interchangeable upper receivers.‘(2) Articles taxable at 50 percent: Shells and cartridges.’.

(b) Exemption for United States- Subsection (b) of section 4182 of the Internal Revenue Code of 1986 is amended to read as follows:

‘(b) Sales to United States- No firearms, pistols, revolvers, lower frame or receiver for a firearm, shells, and cartridges purchased with funds appropriated for any department, agency, or instrumentality of the United States shall be subject to any tax imposed on the sale or transfer of such articles.’

First, this bill won’t get a hearing in the House of Representatives. It’s going nowhere fast. Second, even if such a bill would pass, it wouldn’t reduce gun violence. Violent criminals commit violent crimes. The feds imposing a huge sales tax on guns and ammo won’t stop gun violence because violent criminals don’t buy guns and ammunition from retailers. They buy those things on the black market.

The only impact this legislation would have is on law-abiding citizens. It’ll dramatically drive up the cost of guns and ammunition for law-abiding citizens, making it more difficult for people to defend themselves. This is as nutty as Seattle starting a campaign to announce which stores are gun-free:

MAYOR MCGINN: Over 50 businesses in Seattle have declared themselves as gun-free zones and they would prefer that people not come in with guns. And if they do come in with guns, they will be asked to leave.

GRETA: Mayor, before I got into TV, I was a criminal defense attorney and if my clients heard that there was a store that was part of a gun-free zone, it would be open season on that store. And I know that part of the program is that they put stickers in the windows.

This is just the opening to the interview. Watch the entire thing to see just how naive this mayor is. Frankly, it’s breathtaking.

Technorati: Gun Control, Ammunition Excise Tax, Gun Excise Tax, Bill Pascrell, Danny Davis, Chicago, IL, Gun Free Zones, Seattle, Democrats, Second Amendment, Public Safety, Conservatism

This article is filled with irony from this conservative’s perspective. Los Angeles, Calif., has been the home to the movie industry since before I was born. LA’s new mayor, though, sees the signs that California’s oppressive taxes is hurting his city. In fact, he’s panicking over it:

Hollywood’s homegrown industry is being ceded to other states and countries whose favorable tax credits are increasingly luring away movie and television production at an alarming rate. As competition both in the U.S. and abroad continues to grow, the state’s market share and longtime stronghold on production jobs and spending are fast evaporating.

The simple reality is that tax rates matter. Hollywood isn’t making films because they’re altruistic. They’re attempting to make as tons of money. California’s oppressive taxation is cutting into these companies’ profits:

These days studio chiefs insist that filmmakers they work with take advantage of out-of-state incentives to lower production costs, which on a single major motion picture can amount to savings of tens of millions. Those savings are crucial in a franchise-obsessed era when big-budget movies commonly cost north of $200 million to produce, while on the revenue side the DVD market has largely collapsed and cinema attendance has been generally flat over the past decade. In the current climate, most independent projects would not even be produced without incentives.

This cuts to the heart of the matter. Production companies are going where they stand to make the most profit. If other states offer better incentives, that’s where these companies will go. Rather than offering special incentive packages, California can get these jobs back by simply offering a better tax rate. Unfortunately, that isn’t likely to happen:

“Tomorrow we are not going to wake up with an unlimited cap on credits,” Garcetti says. “But we have to show forward progress, and I am going to be like a dog with a bone on this and stay with this. I can’t single-handedly move Sacramento, but I think we will do what works to educate our lawmakers…that this is a huge shot in the arm for our economy to land a lot of this back.”

Skeptical lawmakers can say that the state already has done what it can: its $100 million-per-year incentive program may not match those of other states (New York’s is about $420 million) but is certainly better than nothing. California elected officials renewed the program, in the midst of ever-tight state budgets, twice. The most recent renewal, a two-year extension to 2017, was passed overwhelmingly even after a state legislative analyst report concluded that the economic benefits of providing incentives would be a wash, or even a slight net loss, to the state’s coffers.

California’s biggest problem is that they’re spending billions of dollars on the trendiest things, things that don’t create jobs. Green energy companies were supposedly California’s newest contribution to the national economy. Instead, they’ve been a total bust.

California spends literally billions of dollars on lavish public employee pensions. Cities have declared bankruptcies as a direct result of these obligations. In order to pay those obligations, California has raised tax rates. They’ve decided that paying these lavish obligations is more important than creating private sector jobs. For that matter, they’ve decided that it’s more important to pay these lavish pension benefits than it is to hold onto jobs that they’ve had for decades.

Until they change their priorities, Californians will continue losing jobs and Eric Garcetti’s crisis will get worse.

Technorati: Hollywood, California, Tax Increases, Public Employee Pensions, Movie Industry, Eric Garcetti, Jerry Brown, Democrats

I wrote here about how President Potter is equally adept at ignoring MnSCU procedures as he is in ignoring SCSU procedures. This post dovetails with that post because it highlights with documentation that President Potter ignored MnSCU procedure in closing the Aviation program. In this morning’s post, I higlighted MnSCU’s procedure for closing programs:

The academic program closure application must be documented by information, as applicable, regarding:

- academic program need.

- student enrollment trends.

- employment of graduates.

- the financial circumstances affecting the academic program, system college or university.

- the plan to accommodate students currently enrolled in the academic program.

- impact on faculty and support staff.

- consultation with appropriate constituent groups including students, faculty and community.

- alternatives considered, and

- other factors affecting academic program operation.

It’s clear that MnSCU procedure 3.36.1 requires that the university document 9 specific things.

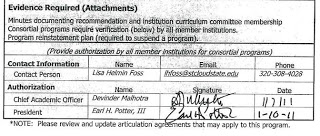

In the program closeout document used by SCSU officials under “Evidence Required” it clearly states that “Consortial programs require verification (below) by all member institutions” above the signature lines. The aviation program had a consortial agreement with Metro State among others. From the form itself, it is a stretch to believe that Lisa Foss, Devinder Malhotra, and Earl Potter simply forgot to obtain the required verification by all member institutions.

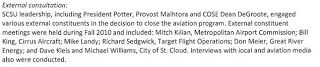

Failure to complete required documentation is foolish. What’s far worse is for a MnSCU administrator to whitewash the matter. A faithful reader provided further evidence the procedures were ignored specifically #7 which addresses the consultation with appropriate constituent groups. In the fall of 2010 after Dean David DeGroote announced the aviation program would close during the university’s reorganizational process, there was an open session on campus run by Provost Devinder Malhotra for university employees to ask questions and provide feedback. Reports indicated there were at least 200 employees present. At the open forum, Aviation Professor Jeff Johnson publicly asked Malhotra in an open mic session if there were any plans for the university to have public hearings beyond the university walls. He gave specific examples of public hearings in the community with business leaders, chamber of commerce members, and the public at large. Johnson explained that closing academic programs can have an impact on the community. Malhotra said no to Johnson’s question. Almost a year later, when MnSCU was pressed for information regarding SCSU’s public hearings by the Dayton Administration, this October 2011 letter from Governor Dayton’s office actually lists the names of the community constituent groups who were “consulted” by Potter’s administration.

The faithful reader noted that all of the external constituents named in this letter (minus Mayor Dave Kleis and administrator Michael Williams) were industry friends of the aviation program who were asked by the aviation department chair to meet with university officials in order to convince them of the importance of the aviation program. Two of the five members were also on the SCSU aviation advisory board. A year earlier, Malhotra said there was not going to be any external public hearings. Governor Dayton’s letter stated this:

“The Minnesota State Colleges and Universities system works to provide its students with the programs that are in the highest demand. In conjunction with deepening budget constraints, the elimination of programs that may not have high employment demand is an unfortunate cost of the current budget situation.”

Last March, Rep. Paul Marquart (Chair of the House Education Finance Committee), along with Rep. Zach Dorholt, had a town hall meeting with St. Cloud area citizens. The presentation was titled, “Putting our Kids on the Path to the World’s Best Workforce.” One handout quoted MnSCU Chancellor Steven Rosenstone. Here’s what Rosenstone said:

Can Minnesota produce the world’s best workforce? Not only can we do it Minnesota absolutely must do it. Producing the world’s best workforce is a state imperative. What’s at stake is nothing less than economic vitality of our state and the quality of life of all Minnesotans.

Gov. Dayton and Chancellor Rosenstone, when was there a high employment demand for graduates requiring a SCSU professor to be paid to run a weed infested community garden? When was there a demand for high end off campus student housing that loses over $1 million dollars per year? How do you justify killing a viable accredited aviation program with a strong industry demand that had over 170 students when SCSU’s enrollments are plummeting?

According to this article, Dayton was specifically mentioned as a player for successfully getting Pinnacle Airlines to move their headquarters to Minnesota. Pinnacle airlines is still doing quite a bit of hiring. Apparently, President Potter’s agenda is clearly not in alignment with the Governor’s and Chancellor’s workforce initiatives.

There are 3 things to keep in mind. First, Provost Malhotra announced that the University wouldn’t consult with transportation experts, business leaders or industry experts. That’s important because MnSCU requires it. Not only does MnSCU require it but it requires these consultations be documented.

Second, 4 of the 5 people listed in Gov. Dayton’s letter as having been consulted by President Potter, Provost Malhotra and Dean DeGroote vehemently opposed closing the Aviation program. Mike Landy passionately opposed closing the program.

Third, when President Potter decided to close the Aviation program, he ignored the opinions of aviation industry experts, instead choosing to close a program he once called one of the best in the nation.

In short, this administration was secretive, unwilling to listen to industry experts, then packaged a bunch of things together to make it look like they followed MnSCU procedures. What could possibly go wrong?

Technorati: Earl Potter, Devinder Malhotra, David DeGroote, Mark Dayton, MNSCU, Aviation Experts, Transportation Experts, Aviation Program, St. Cloud State, Documentation

This article highlights Richard Vedder’s thoughts on why college isn’t getting more affordable:

Some college officials are also compensated more handsomely than CEOs. Since 2000, New York University has provided $90 million in loans, many of them zero-interest and forgivable, to administrators and faculty to buy houses and summer homes on Fire Island and the Hamptons.

Former Ohio State President Gordon Gee (who resigned in June after making defamatory remarks about Catholics) earned nearly $2 million in compensation last year while living in a 9,630 square-foot Tudor mansion on a 1.3-acre estate. The Columbus Camelot includes $673,000 in art decor and a $532 shower curtain in a guest bathroom. Ohio State also paid roughly $23,000 per month for Mr. Gee’s soirees and half a million for him to travel the country on a private jet. Such taxpayer-funded extravagance has not made its way into Mr. Obama’s speeches.

Colleges have also used the gusher of taxpayer dollars to hire more administrators to manage their bloated bureaucracies and proliferating multicultural programs. The University of California system employs 2,358 administrative staff in just its president’s office.

The thought that a university president would get $2,000,000 in compensation is awful enough. The fact that he got that in addition to living in a 10,000 sq.ft. home while travelling the country in a private jet is infuriating. Add to that the fact that he made “defamatory remarks about Catholics” and you’ve got the profile of an over-compensated spoiled brat.

That 2,358 administrative staff work in the Univerity of California’s president’s office speaks to how out of touch universities have gotten. It gets worse:

Many colleges, he notes, are using federal largess to finance Hilton-like dorms and Club Med amenities. Stanford offers more classes in yoga than Shakespeare. A warning to parents whose kids sign up for “Core Training”: The course isn’t a rigorous study of the classics, but rather involves rigorous exercise to strengthen the glutes and abs.

St. Cloud State is a blue collar university. This isn’t disrespectful. It’s a characterization of the backgrounds students come from. Their version of the “Hilton-like dorms” is the Coborns Plaza. Silence Dogood wrote about that in this post:

Coborn’s Plaza apartments have been a well-kept secret since they opened in the fall of 2010. Even getting accurate occupancy numbers during the first two years was difficult and only given in whispers with those hearing the secrets being sworn to secrecy. Some of that secrecy ended November 13, 2012 when Len Sippel, Interim Vice President for Finance and Administration, released the list of approved funding for permanent investments that included $2,250,000 for the “Coborn’s Welcome Center.”

This eye-popping number actually covers the deficit for Coborn’s Plaza for the last two years so the loss only averages $1,125,000 per year. The amount of the loss for the first year for Coborn’s Plaza has never been shared with the Faculty Association or made public.

Based on Vedder’s interview and local reporting, fiscal mismanagement isn’t just the norm at high profile universities. Everyone’s gotten on the gravy train. (Is this what President Obama meant when he talked about spreading the wealth around?)

Then there’s this:

Or consider Princeton, which recently built a resplendent $136 million student residence with leaded glass windows and a cavernous oak dining hall (paid for in part with a $30 million tax-deductible donation by Hewlett-Packard CEO Meg Whitman). The dorm’s cost approached $300,000 per bed.

Many of these presidents think that cavernous, gleaming monstrosities are part of their legacies. They aren’t. University presidents aren’t high profile enough to have legacies like presidents and senators have. Furthermore, they’re supposed to be good stewards of the taxpayers’ money. Clearly, that isn’t happening.

Technorati: Higher Education, Richard Vedder, Center for College Affordability and Productivity, Think Tank, Economist, Princeton, University of California, Meg Whitman, Endowments, Gordon Gee, Ohio State University, Compensation, Private Jet, Mansion

During the Political Analysis segment of At Issue With Tom Hauser, former DFL State Senator Don Betzold admitted that some tax hikes were put into the bill late in the session that Gov. Dayton didn’t know were in the bill he signed. He then talked about how hectic the last weekend of the session is.

What he didn’t admit is that past end-of-session weekends have involved a governor of one party and the legislature of the other party. That wasn’t the case this time. The DFL owned it all from opening gavel to closing bell.

Not only that but the DFL leadership announced that they’d reached a Tax Bill agreement a week before end of session:

Thissen, Gov. Mark Dayton and Senate Majority Leader Tom Bakk of Cook said they agreed on spending targets and will give conference committees a few other guidelines, such as:

- The sales tax would not rise on consumer goods, including clothing, but businesses could pay sales tax on goods sold to other businesses.

- taxes would go up on people in the top 2 percent of Minnesota earners, couples with $250,000 or more taxable income.

- An income tax surcharge would be added for Minnesota’s richest of the rich, with proceeds going to help repay money the state has borrowed from school districts.

- Cigarette taxes would rise.

- Some business tax breaks would disappear.

- All-day kindergarten would be funded.

- The state would spend $400 million in property tax relief, such as by increasing aid sent to local governments.

In short, Gov. Dayton, Speaker Thissen and Senate Majority Leader Bakk knew that the warehouse tax, the telcommunications tax and the farm equipment tax would be in the final tax bill because that’s what they negotiated.

The DFL owns the tax hikes because they passed them without GOP support. The DFL owns them because they were their idea. The DFL owns them because their leadership in St. Paul negotiated them into the final Tax Bill.

This wasn’t a high speed train crash. It was a slow-motion train wreck. Businesses lobbied against these taxes. The DFL ignored their lobbying efforts and passed them anyway. Eventually, they realized they’d made a political mistake. (I’m not certain they understand they made a policy mistake.)

Later, Gov. Dayton promised f.armers at FarmFest that he’d repeal the farm equipment repair sales tax during the special session. In the end, he broke that promise, too.

Technorati: Tax Increases, Broken Promises, Budget Negotiations, Deadlines, Tom Bakk, Paul Thissen, Mark Dayton, DFL, Farm Equipment Repair Sales Tax, Warehouse Tax, Telecommunications Sales Tax, Farmers, Small Businesses

It’s abundantly clear that procedures don’t mean much to MnSCU or SCSU. When President Potter announced the cancellation of the Aviation Program at St. Cloud State, he ignored MnSCU procedure 3.36.1, which requires the following things be documented:

The academic program closure application must be documented by information, as applicable, regarding:

- academic program need.

- student enrollment trends.

- employment of graduates.

- the financial circumstances affecting the academic program, system college or university.

- the plan to accommodate students currently enrolled in the academic program.

- impact on faculty and support staff.

- consultation with appropriate constituent groups including students, faculty and community.

- alternatives considered, and

- other factors affecting academic program operation.

I wrote this article about how President Potter ignored MnSCU policy and how MnSCU let him get away with it. When a grievance was filed, MnSCU assigned Larry Litecky to investigate. Here’s the key part of his response:

As one whose staff is charged with the responsibility to review college and university closure requests, I disagree. My staff and I remain persuaded that the university conducted required and appropriate consultations and assessments that informed its decisions.

It wasn’t Dr. Litecky’s responsibility to be persuaded. His responsibility was to verify whether SCSU provided the documentation required or whether they hadn’t. In this case, they hadn’t provide documentation of the first 2 points.

There’s no documentation proving the Aviation Program wasn’t needed because there’s a worldwide pilot shortage. Boeing thinks that shortage will las the better part of 30 years. Likewise, there wasn’t documentation that enrollment was still in decline when President Potter made his announcement. Enrollment decreases had ended and started climbing again.

That’s before talking about “consultation with … students. Aviation students weren’t consulted prior to President Potter’s on-campus announcement. In fact, when aviation students voiced their opinions, President Potter yelled at them:

Furthermore, later, as the meeting progressed, President Potter yelled at myself, as well as another student. He raised his voice at me and mentioned, “do not take that tone with me…” while he leaned over the table with both hands on the table. At this point, I literally shut down as the other 4 individuals resumed the meeting. He also yelled at another student with the same tone and words.

Fast forward to last Thursday’s column by Phyllis vanBuren, which I wrote about here. In her colummn that the St. Cloud Times published, Dr. vanBuren wrote about a new procedure being put in place about changing grades post-term. Here’s what Dr. vanBuren wrote:

Administration also acknowledged in October the two ways that grades may be altered “post term.” One is to change the grade, and the other is to remove the course from the transcript. The association requested written documentation of the reasons for granting such a request. Administration replied that such policies and procedures exist and that faculty are notified.

According to the M& C minutes from October, the FA disagreed with that contention.

Three months later, on Jan. 7, a policies and procedures document was uploaded to the university’s Web page. It specifies that faculty will be involved. It also states that administration will provide annual reports to the association about grade changes by administration.

Since then, Provost Maholtra has declared the problem solved:

The Provost office research found that from July 2011 to June 2012, approximately 1,200 requests were made by students to drop or withdraw from classes post deadline. Of those, 237 requests were surveyed. The Provost office found that faculty members were contacted in all of those cases and 69 percent of them signed off they had received and evaluated the request. The remaining 31 percent was found to be unclear of their response.

In their words, the problem is solved. Never admitted to is more like it.

The reality is that poofs, the thing President Potter hasn’t admitted to, still continue to this day. First, it’s time President Potter admitted that they’ve happened. Second, it’s time President Potter admitted that they’re still happening. Anyone that’s worked with President Potter knows there’s a better chance of seeing unicorns than seeing him admit that poofs are still happening.

Technorati: Transcript Fraud, Earl Potter, Devinder Maholtra, Adam Hammer, Administration, Phyllis vanBuren, Meet And Confer, MnSCU, SCSU

This morning, the St. Cloud Times published Professor Phyllis van Buren’s monthly column as part of the Times Writers Group. Prof. van Buren’s column this month was an extensive dissertation on the transcript fiasco at St. Cloud State. Readers of this blog know that that’s a subject that I’ve investigated and written about extensively.

I take great pride in the fact that many of the things I’ve written are things that Dr. van Buren included in her article. Here’s an example:

Two years ago, a student in my class completed all requirements but the final, requesting to take the final in early January. She did not then nor in April, when another faculty member contacted me on her behalf for yet another chance. Her grade for the semester was a solid F — even if she would have earned 100 percent on the written final.

However, a year later, she requested a withdrawal for all her courses. I provided detailed evidence that she had completed the semester and reasons for denying the appeal. I later received an email that her request had been granted despite my recommendation. I contacted the registrar’s office to learn that two professors had denied her request and two had complied. Yet a W was awarded for all four classes. My prompt reaction re-instated the earned grade for my class.

I’ve talked with a handful of SCSU professors about this type of situation. Each has told me that a student that requests extra time to complete the work for their course, then doesn’t complete the work for the class, will get an F as their final grade barring something extraordinary happening.

It’s obvious that there weren’t any extenuating or mitigating circumstances involved in Prof. van Buren’s decision. If mitigating circumstances existed, the administration’s decision would’ve been upheld. It wasn’t.

I also have read recent Meet & Confer notes between university administration and faculty. I have searched the university’s Web page for policies and procedures. I have spoken with people who attended the M&C meetings, and I have listened to a recorded conversation about the ways to amend records to improve students’ GPA for admission to programs.

The University’s Meet & Confer minutes helped me piece the puzzle together. Dr. van Buren was exactly right in going through those minutes for information about the Potter administration’s stonewalling. I wrote here about how the Potter administration didn’t think this was worthy of an investigation:

Admin: Sure so then we have as to what kind of data is relevant and we go there and we can collect the information so that it makes sense for you. The other thing is I won’t call it an investigation I would call analysis.

When students’ participation in a class disappears, that’s justification to investigate. As for the “recorded conversation about ways to amend records to improve students’ GPA for admission to programs”, I’ve had a tip about who they’re talking about. Without independent verification, though, I won’t speculate.

Meet & Confer sessions are held regularly between the Faculty Association and St. Cloud State’s administration. On every agenda of M&C minutes from October 2012 through this May, the topic of grades changes appeared.

The minutes show there is a lot of finger-pointing and the need for data sharing and adherence to policies and practices by students, faculty and administration. There are two main issues. One involves changing grades, usually to a W. The other involves the possibility of dropping classes from transcripts without informing faculty.

University spokesman Adam Hammer tried explaining the fiasco this way:

In addressing this concern at a meet and confirm meeting conducted amongst university professors and administration, Hammer said the cause for concern primarily dealt with late drops and withdrawals.

According to Dr. van Buren and Dr. Leenay, late drops and withdrawals are only part of the problem. Dr. van Buren’s and Dr. Leenay’s biggest concern is with students’ participation in classes getting whitewashed. That’s a way to inflate students’ grade and it isn’t acceptable.

Thanks to Dr. van Buren’s article, people are finally getting a picture of what’s actually happening at SCSU instead of getting the Potter administration’s spin of what’s happening on campus.

If the Potter administration won’t admit that grades are disappearing, then the legislature will have to intervene. The House and Senate Higher Education committees will have to intervene because, if they don’t, they’ll send the signal that administrations can do whatever they want. That isn’t acceptable.

Technorati: Phyllis van Buren, Grade Inflation, Meet And Confer Meetings, Poofs, Investigation, Faculty Association, Earl Potter, Adam Hammer, Devinder Maholtra, Faculty Association, St. Cloud State