Spring Semester Falloff—A Comparison Of SCSU With Mankato

by Silence Dogood

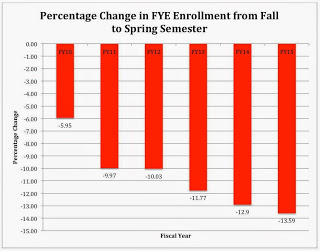

Spring Semester FYE enrollment is always lower than the preceding Fall semester FYE enrollment. The following plot shows the percent change in FYE enrollment from Fall to the following Spring Semester for SCSU.

Unfortunately, as shown in the figure, for SCSU, the decline from Fall Semester to Spring Semester is increasing.

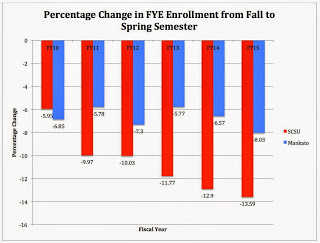

Frequently, I have compared the performance of SCSU and MSUM—Mankato. These two MnSCU universities have very similar histories, are the two largest universities in MnSCU, and are both of similar size. Recently, it seems that SCSU has come up short in most comparisons.

Just out of curiosity, I wondered what kind of falloff of FYE enrollment from Fall Semester to Spring Semester that Mankato experienced. The following figure shows the data for FY15 as of February 15, 2015 for both SCSU and Mankato.

The data clearly shows that Mankato shows a falloff in FYE enrollment from Fall Semester to Spring Semester. However, while the two were within 1% in FY10, Mankato has been relatively stable while SCSU has gone into a significant decline.

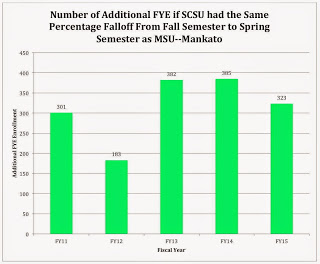

If SCSU’s falloff in FYE enrollment for FY11 through FY15 had been the same as that at MSU—Mankato, SCSU would have a larger FYE enrollment in Spring Semester. The following figure shows the number of additional FYE by fiscal year.

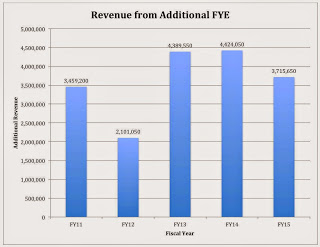

FYE translates into revenue. There is a two-year lag in the state appropriation so while enrollment is going down, the funding does not go down as fast as the enrollment. The idea behind this is that, as enrollment is going down, you have some time to adjust before the appropriation is cut. Based on $11,500 per student, this additional FYE enrollment would generate additional revenue shown in the following figure:

In FY15, the figure shows that if SCSU had the same percentage falloff in FYE enrollment as Mankato, it would bring in an additional $3,700,000 in revenue (tuition and state appropriation) in just that year. Considering that for FY16 SCSU is looking at a deficit of $12,000,000 - $16,000,000, this might not seem to be enough to solve the budget crisis. However, you need to recognize that each student retained means that the following term you start with a higher number, which directly translates into additional revenue. As a result, the additional revenue from FY11 would actually compound and grow. Certainly, not all of those 301 FYE in Spring 2011 would have been back for Fall 2011 but if 75% of them came back, it would an additional $2,590,000 in revenue in Fall 2011. Additionally, this then gives you a higher starting number for retention for the following semester as well, which means even more revenue going forward and so on.

Using SCSU’s own spring to fall historical retention numbers, I’m pretty confident that the additional revenue in FY11 would have grown substantially—perhaps even to the point of completely covering SCSU’s $9,542,000 deficit for FY15.

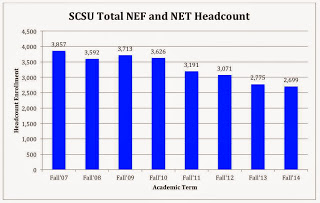

Unfortunately, when you couple the poor retention numbers with declining numbers of New Entering Freshmen (NEF) and New Entering Transfer (NET) students as shown in the following figure, you have a “perfect storm” as described by President Potter in SCSU’s FY15 Financial Recovery Plan:

The 30.0% decline in NEF/NET numbers from Fall 2007 to Fall 2014 happened on President Potter’s watch. It is also relevant to note that the steepest decline came in Fall 2011 on the heels of his reorganization of the university to make it “more efficient” and better able to respond to change. From Fall 2010 to Fall 2015, NEF/NET enrollment dropped by an amazing 25.6%! It seems that the only efficiency gained by reorganization was in dramatically reducing the number of NEF and NET students enrolling at SCSU.

Clearly, SCSU’s “perfect storm” is of its own making and has created a deep financial hole. The first step to get out of that hole is to understand how you got there in the first place. That means you have to accept responsibility and stop blaming others or other things. It is not possible to move forward in any positive way if you keep thinking that things were just done to you and that you were in no way responsible.

As a start, let’s stop calling the loss of $7,700,000 on the Coborn’s Plaza Apartments in the first five years of operation “a success.” Clearly, it isn’t. Based on the lease with the Wedum foundation, SCSU is likely to lose over $6,000,000 in the next five years before it can get out of the contact and it might cost another $6,000,000 if we do not get out of the lease. While that failed project is not the only cause of SCSU’s financial hole, it certainly has contributed over a million a year in spending.

When coupled with all of the other expenses SCSU now has to cover—the operating costs and debt service for ISELF, losses on the parking ramp, loan repayment and debt service on the Brooks Center, police officers on campus, the Confucius Institute, and the list goes on—SCSU is in a much poorer financial condition as reflected in a 0.07 CFI for FY14. Given the current financial situation, a 5.1% enrollment decline in FY15 plus an additional 3.3% decline in enrollment for FY16, the CFI for SCSU will likely go negative for FY15.

It has been said that:

“The darkest hour is just before the dawn.”

The meaning of this is that there is hope, even in the worst of circumstances. Unfortunately, unless you know when the dawn is, it is hard to know if you have reached the darkest hour. For SCSU, it probably isn’t possible to answer that question with certainty because of the number of moving and interconnected parts. At best, all that can be said is the sun will eventually rise. How bad it will get at SCSU before then is anybody’s guess.