Archive for the ‘Reforms’ Category

There’s a penalty Minnesotans are paying for electing divided government. That penalty comes in the form of higher taxes, more intrusive regulations and a regulatory structure that gives special interests too many bites at the proverbial apple.

When the DFL ran St. Paul in 2013-14, they rammed huge tax and spending increases down our throats. That’s when Minnesota became less competitive in terms of business environment. The truth is that Minnesota has an outmigration of wealth and talent for years. It isn’t just retirees, either, moving to warmer climates. It’s young people moving to other states to start businesses where taxes and regulations aren’t oppressive.

The regulatory regime isn’t the same as the regulations. For PolyMet to start operations, they have to get approval from the DNR, MPCA, the Department of Health, the Board of Water and Soil Resources (BOWSR), the Public Utilities Commission in addition to local watershed districts and other regulators. It isn’t surprising that people — and wealth are leaving.

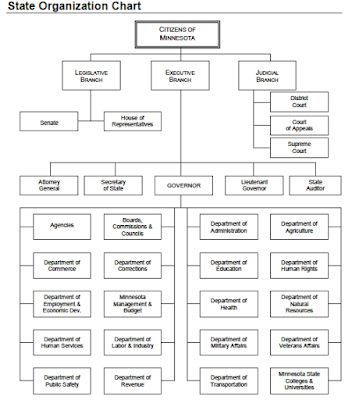

This is an organizational chart of Minnesota’s executive branch:

Within the executive branch, there are close to 2 dozen regulatory agencies. They include the MPCA, BOWSR, the DNR, Department of Health, Met Council, the Public Utilities Commission, the Board on Environmental Quality, the State Climatology Office, the Department of Commerce, the Board of Energy, the Minnesota Forest Resources Council, the Minnesota Geological Survey, the Minnesota Indian Affairs Council, the Office of Energy Security, the Office of Pipeline Safety, just to name a few.

The point is that the DFL has controlled at least one part of government my entire adult life. It has created a convoluted system of government that’s stuck in the Twentieth Century. The DFL insists on maintaining a mainframe government in an iPad world.

Gov. Dayton and then-Lt. Gov. Tina Smith ignored welfare fraud, elder care abuse and overseen IT disasters like MNsure and MNLARS. When the DFL had majorities in the House and Senate and Gov. Dayton was governor, they raised taxes and raised the state minimum wage, then indexed it to inflation. Further, the DFL hasn’t reformed anything like the IRRRB or the Met Council in forever. They’ve participated in scandals like the Action Minneapolis rip-off, too.

Considering all those things, I can’t justify why they should hold any levers of power in St. Paul.

It isn’t a stretch to say that the DFL hates cutting taxes. Further, it isn’t a stretch to think that the DFL doesn’t understand economics. When Democrats, whether they’re in the US Senate or the Minnesota legislature, complain about tax cuts for “the rich”, I’m reminded of Ronald Reagan’s cliché that you can’t create jobs if you hurt employers. There’s indisputable proof that companies are leaving the US for low-tax countries. Not all companies leave but there’s no doubt that many companies do.

Yesterday, the Minnesota Supreme Court ruled that Gov. Dayton’s veto of the legislature’s operating budget was constitutional. At the heart of that fight is Gov. Dayton’s hatred of tax relief. If Gov. Dayton understood the power of pro-growth tax policies, he wouldn’t have objected to the Republicans’ tax relief bill.

Further, after watching every DFL legislator vote against the tax relief package last spring, it isn’t a dishonest statement to say that the DFL hate pro-growth tax policies. At what point will the DFL admit that pro-growth tax policies work? Will they ever admit that?

It isn’t just DFL legislators that hate pro-growth tax policies. By now, most LFR readers have seen this fight between ‘Uncle Orrin’ Hatch, (R-UT), and Sherrod Brown, (D-OH), during Thursday night’s mark-up of the Senate Tax Cuts and Job Act:

Way to go, Uncle Orrin! That’s what I’d call a beat-down! Beyond seeing Republicans fighting Democrats over the benefits of this pro-growth tax policy, that exchange is instructive because Sen. Brown said something totally stupid. Specifically, Sen. Brown said “And I get sick and tired of the rich always getting richer.” Let me state this clearly. I can’t imagine a politician saying something more foolish than that. Why wouldn’t you want the rich to keep getting richer? If they aren’t getting richer, that means that they aren’t making a profit. People that aren’t making a profit can’t continue employing people.

I don’t know who Republicans will run against Sen. Brown but whoever they run should run that clip morning, noon and night against Sen. Brown. I’d finish the ad by asking ‘Was Sherrod Brown just gratuitously grandstanding? Or is he that economically ignorant?’

Seriously, how can a U.S. senator be that stupid? That’s painful to watch.

Technorati: Ronald Reagan, Orrin Hatch, Tax Cut and Jobs Act, Republicans, Sherrod Brown, Demagogue, Mark Dayton, Tax the Rich, DFL, Election 2018

It’s now official. Blue Dog Democrats officially stated that they oppose middle class tax cuts and tax simplification. They officially stated “We simply cannot support a bill that, by every kind of measurement, has been determined to add over $2 trillion to the deficit at the expense of middle-class Americans. It’s a fact that some middle-class Americans will see their taxes go up and small business owners will face a more complex tax system under this bill.”

Their statement went further, saying “Unrealistic, rosy economic growth projections should not be used to offset the costs of tax reform or tax relief.”

During the Obama administration, Blue Dog Democrats sat silent. They didn’t offer plans to simplify the tax code or provide middle class tax relief. They especially didn’t criticize President Obama’s super-sized deficits. Simply put, they acted like spineless eunuchs. Now that there’s a Republican president that’s pushing major improvements to the tax code, though, Blue Dogs are suddenly criticizing plans that will strengthen the economy, create jobs and grow families’ 401(k)s.

Their position paper supports corporate tax reduction, income tax simplification, and emphasizes deficit reduction.

That’s nice-sounding but it’s totally BS. They were nowhere to be found for 8 long yeas on the topic of deficit reduction. Had they stood up to President Obama and Nancy Pelosi back then, they’d have some credibility.

Legitimate conservatives have a different idea:

Thanks to Republicans, tax relief will soon become reality. During her interview with Kevin Brady, Harris Faulkner asked him if they’d done a whip count. Chairman Brady said that they’d done a whip count and that they had the 218 votes needed to pass the House Bill:

The Senate bill includes the repeal of the individual mandate, which isn’t part of the House’s legislation. Last night during his townhall, however, Speaker Ryan said that House Republicans didn’t have a problem with repealing the individual mandate. Chairman Brady said that they wouldn’t add it to the House bill but said that they wouldn’t have a problem agreeing to it in the conference committee negotiations.

UPDATE: Ron Johnson just announced that he won’t vote for the Tax Bill in its current form:

“We have an opportunity to enact paradigm-shifting tax reform that makes American businesses globally competitive, helps our economy reach its full potential, and creates greater opportunity and bigger paychecks for every American. In doing so, it is important to maintain the domestic competitive position and balance between large publicly traded C corporations and ‘pass-through entities’ (subchapter S corporations, partnerships and sole proprietorships). These businesses truly are the engines of innovation and job creation throughout our economy, and they should not be left behind. Unfortunately, neither the House nor Senate bill provide fair treatment, so I do not support either in their current versions. I do, however, look forward to working with my colleagues to address the disparity so I can support the final version.”

The key part of Sen. Johnson’s statement is where he said “I do not support either in their current versions. I do, however, look forward to working with my colleagues to address the disparity so I can support the final version.” That isn’t slamming the door shut. It’s leaving the door wide open. Frankly, this sounds more like the opening of negotiations rather than a rejection.

Tuesday night, Speaker Ryan was Bret Baier’s and Martha MacCallum’s guest for a townhall meeting in Herndon, Virginia. Specifically, the subject was the Tax Cut and Jobs Act. It would be fun watching him slice-and-dice Nancy Pelosi on the subject, though I’m certain she’d never participate in such a debate.

Ryan on how the tax cuts would help veterans:

Ryan on small business growth:

(Notice the specificity of his response.)

Ryan on the need to grow the economy:

Thus far, the Democrats’ economic plan is to criticize the Republican plan. That’s the plan offered by Pelosi and Schumer. That’s bad enough. The Bernie/Warren plan is even worse. They want to raise taxes and drive companies overseas.

Do we want a vibrant economy led by robust small business investment or do we want the pathetic economic growth we had during the Obama administration? That’s a pretty easy answer for most people.

Thursday afternoon, I appeared on KNSI’s Ox in the Afternoon to talk about Ashish Vaidya’s announcement that he’s leaving MnSCU (and Minnesota) to become the next president at Northern Kentucky University. Follow this link to listen to that interview. It’s the third interview on the page. But I digress.

During the interview, Ox brought up the subject of what’s next for the University. He mentioned this while questioning whether the University was beyond the point of saving. At that point, I said that, had someone told me 5 years ago that we’d be having this conversation, I likely would’ve taken that bet. The possibility of St. Cloud shutting its doors was unthinkable at that time. It isn’t unthinkable anymore.

To be substantive, though, what’s needed is a rethinking of the management style at SCSU. First, what’s required is a president who isn’t worried about whether his decisions will hurt his career. What’s needed is someone with the intelligence, and willingness, to trim the fat from the administration. Initially, those savings should go into rebuilding the faculty and into scholarships to get students interested in the University.

The other thing that’s needed is the rebuilding of the Aviation Department. Frankly, it was a major mistake to eliminate that program. Right now, there are major wildfires burning in the mountain west. There’s no reason why SCSU couldn’t have a program that trains students in firefighting and rescue operations. It isn’t like they’re getting trained at community colleges or trade schools. Another program that should fit into that Aviation Department is drone training.

With border security becoming a high priority with the federal government, new high-paying jobs are virtually guaranteed upon graduation. From what I’m told, those jobs come with $50,000-$75,000 a year starting pay and virtually 100% placement upon graduation. Call me crazy but a program like that sounds like an enrollment magnet.

Once the enrollment starts improving, there will be other issues that need addressing. A major review and overhaul of the University’s financial decisions is required. Systems need to be put in place to eliminate some of the past decisions and prevent them from happening again. There can’t be another contract signed with the Wedum Foundation. That contract hurt the University badly. I know the perfect person for that position.

We need a president that will instantly connect with area principals. What’s needed, too, is someone who will sell the University’s programs. It’s imperative to immediately create a positive buzz about the University. There isn’t time for a search committee. What’s needed is someone who’s already familiar with SCSU and someone who’s a no-nonsense person. That immediately eliminates Roland Specht-Jarvis from serious consideration. He knows the turf but he’s too into playing politics.

The next president needs to be given the authority to clean house. He needs to be able to pick his own team and the authority to make unpopular but needed decisions. Another thing that the next president will need is unwavering support from civic leaders and financial help from the legislature. I’m not proposing throwing good money after bad. I’m talking about the next president having a plan that they want to execute and the wherewithal to implement that plan.

That plan needs to return the University to the things that made it successful. Rebuild the School of Business. Restart the Aviation Program. Re-open other successful schools. Implementing that plan will create a positive buzz that turns the University around in a proverbial heartbeat.

The Chamber of Commerce needs to step forward and support the new president. A failing university isn’t helping St. Cloud’s economy. If they prefer playing both sides, the University loses. If the University loses, so does St. Cloud’s economy.

The reforms that St. Cloud State needs also are required at MnSCU. My hope is that GOP gubernatorial candidates take this opportunity to fix the disaster that was created in the 1990s. MnSCU has been a disaster from the day it was signed into law. It’s accountable to no one. It hasn’t done what it promised to do. MnSCU’s Board of Trustees is filled with ex-politicians who are essentially waiting for their next political campaign to happen. Universities need to be accountable to their communities, not to a bunch of career politicians 50+ miles away.

This is a nice blueprint to copy:

The presidential search committee, composed of NKU’s Board of Regents, faculty, staff, students and community members, recommended Vaidya after an eight-month process. The board of regents unanimously elected him Wednesday morning.

It isn’t that MnSCU needs a search committee to find the next president of St. Cloud State. It’s that the next president needs the support of “faculty, staff, students and community members.”

Technorati: St. Cloud State, Ashish Vaidya, Northern Kentucky University, Aviation Program, MnSCU, Chamber of Commerce, Reforms, Enrollment Plan, School of Business, Financial Stability, Legislature

If any paragraph written establishes as fact that tax simplification is needed, it’s found in this article. Specifically, the paragraph that says “To finance a 15 percent cut in the corporate tax rate, House Republicans have already signed on to revenue-generating measures that would weaken the real-estate market, hurt orphans, disadvantage the disabled, hobble research on cures for rare diseases, make it harder for veterans to find jobs, soak upper-middle-class voters in blue states — and, thereby, put their caucus’s most vulnerable members at grave political risk.”

Predictably, every DC lobbyist is whining about their special carve-outs getting eliminated. The lobbyists’ goal is to portray each deduction as essential to the health of that specific industry. In 1986, most of the tax code’s deductions were stripped away. Not only didn’t the economy falter, the economy kept chugging along.

Think of this hysteria as a Chicken Little defense.

This is a bit deceptive:

According to the JCT, if the Republican plan passes, one-fifth of American households will pay higher taxes in 2027. While more middle-class families would be helped than hurt by the GOP plan, the fact that any will wind up forking over more money to Uncle Sam, while the super rich and corporate America collect trillions in benefits, is a political migraine for Trump & Co.

If the bill is passed using reconciliation, the tax cuts expire in 2026. The chances of those tax cuts being allowed to expire isn’t nothing but the chances aren’t exactly high, either.

There is one way around this impasse. Republicans could make the House plan better for the middle class, and easier on the deficit, at the same time, if they’d only scale back their $2 trillion giveaway to corporate America.

Thanks to the Obama tax increase, there’s now over $4,000,000,000,000 in profits sitting overseas rather than being invested here in the United States. Fairness sounds nice but it’s the best way to quiet the US economy. The Obama administration was famous for economic silence. We don’t want a replay of those years. The quack that wrote the base article is hysterical, not credible. The expert in this video is credible:

If there’s a message coming from Newt Gingrich’s op-ed, it’s that Republicans must put together a compelling message to pass the Tax Cuts and Jobs Act. Gingrich reminds Republicans that “passing serious legislation is very hard work. There is still a great deal to do, and the timeline is incredibly tight”, adding that “The Joint Committee on Taxation has already provided preliminary analysis for the bill. Its estimates are static and assume tax cuts will have no impact on growth. As a result of this bad assumption, the JCT incorrectly estimates the bill would create a significant budget shortfall, $1.43 trillion over 10 years.”

Gingrich continued, saying “The truth is, our gross domestic product is growing at 3 percent, largely due to deregulatory efforts by the Trump administration and the expectation of tax cuts. Passage of the Tax Cuts and Jobs Act would further spur GDP growth, so the bill should be scored dynamically. The Tax Foundation has made dynamic estimates on the Tax Cuts and Jobs Act, which show the bill would ‘significantly lower marginal tax rates and the cost of capital, which would lead to 3.9 percent higher GDP over the long term, 3.1 percent higher wages, and an additional 975,000 full-time equivalent jobs.’ This economic growth would raise federal revenues by nearly $1 trillion over 10 years, according to the Tax Foundation. In the end, this new revenue could bring the bill close to neutral, depending on what baseline is used to score it.”

Let’s get serious about something. The Tax Cuts and Jobs Act will speed up the economy. That’s indisputable even though Nancy Pelosi insisted in this speech that it would kill jobs. Ms. Pelosi has told lots of whoppers in the past. This is another whopper. Republicans seem interested in self-destruction.

Sen. Lankford has announced his opposition to it because it supposedly increases the deficit. Here’s a simple question for Sen. Lankford. If Republicans fail to pass this bill, what’s the likelihood they’ll have to vote on a Democrat budget that would hurt job creation and economic growth? What’s the likelihood that a Democrat budget would increase the deficit more than this bill would?

The Tax Cuts and Jobs Act isn’t perfect but it’s definitely a step in the right direction. There’s economic growth happening right now. This isn’t just the right time to pass tax cuts. It’s the best time to pass the Tax Cuts and Jobs Act.

Technorati: Tax Cuts and Jobs Act, Dynamic Scoring, Static Scoring, James Lankford, Job Creation, Economic Growth, Republicans, Deficits, Nancy Pelosi, Democrats

This USA Today Our View editorial is biased and unworthy of serious consideration. That said, it’s instructive of what Republicans will have to fight.

For instance, the editorial says “The measure’s cut in the corporate income tax rate from 35% to 20%, for example, could boost the economy. And its limit on the interest deduction for new mortgages has angered the powerful homebuilding and Realtor lobbies, which suggests that its drafters might be doing something right. But by the standards of President Reagan’s landmark 1986 tax reform, this plan is a major disappointment. It lacks fiscal discipline, is needlessly indulgent of the wealthy, and is purposely punitive to universities, college students and people who live in high-tax states. Taken as a whole, this plan is partisan, even petty.”

Let’s examine that. It isn’t that cutting “the corporate income tax rate from 35% to 20%” might boost the economy. Cutting that tax rate will boost the economy. The DJIA is chomping at the bit waiting for that tax rate cut. If it becomes reality, expect companies to invest that extra capital into hiring extra R & D personnel. Expect small businesses to buy new equipment, which, in turn, will strengthen the manufacturing sector and durable goods orders.

With consumer confidence shooting through the roof, it likely wouldn’t take much to get the economy roaring. It’s disappointing, though predictable, for the editorial to say that the tax plan “is needlessly indulgent of the wealthy.” President Reagan was fond of saying that it’s impossible to be pro-jobs and anti-employer. The first Reagan tax cuts were on capital gains with the intent on getting Detroit back on its feet. It worked magnificently. Then there’s this:

Preliminary estimates are that it would increase deficits by $1.5 trillion over 10 years. To put that in perspective, an only slightly different cast of GOP lawmakers screamed bloody murder in 2009 over an Obama economic stimulus plan half that size. Republicans were deficit hawks then. Now, not so much.

I wrote about the stimulus back in the day. It just threw money at people. Republicans predicted that it wouldn’t spur the economy. The Republicans’ predictions were right. Further, Republicans argued that the Obama stimulus was nothing but pork. They were right. It’s foolish to argue that the Republicans’ Tax Cuts and Jobs Act is nothing but pork and special favors. Predictably, though, that’s what the Democrats are doing.

Finally, saying that “an only slightly different cast of GOP lawmakers screamed bloody murder in 2009 over an Obama economic stimulus” is mathematically insulting. There were 178 Republicans in the House in 2009. There are 239 Republicans in the House as of Oct. 21. That’s a difference of 61 Republicans in the House. I wouldn’t call that a “slightly different cast of GOP lawmakers.”

Then there’s this BS:

The biggest flaw in the GOP plan is that, for all the rhetoric about helping the middle class, it is tilted toward the wealthy. Benefits for the rich include:

Termination of the tax on inherited wealth, a priority of wealthy GOP donors but not many other Americans. Immediately upon passage, estates of up to $22 million could be passed on to heirs tax-free. After six years, estates of any size could be passed on tax-free. Over a decade, this change alone would drain $172 billion from the Treasury.

The wealth that’s been accumulated in these estates has been taxed already. It’s been taxed at a high rate, too. There’s nothing moral about the government taxing estates twice.

Further, this doesn’t benefit the wealthy. People like the Gates family, the Clinton family or the Dayton family create foundations to shelter their wealth. Family farmers would benefit from this. Small business owners would benefit, too.

In the first 4 parts of this series (found here, here, here and here), I focused on different facets of the inadequacies of the Dayton-Rothman Commerce Department. I categorized each of the shortcomings and culprits. Most importantly, I identified the opportunities that the Dayton-Rothman Commerce Department missed and why.

This article will pull everything together so we can put together a less hostile, more business-friendly set of policies that doesn’t sacrifice the environment. First, we’ll need to streamline the regulatory review process so hostile environmental activists don’t have multiple opportunities to throttle key infrastructure projects. Whether we’re talking about killing the Sandpiper Pipeline project, the constant attempts by the Sierra Club, Conservation Minnesota and Northeastern Minnesotans for Wilderness to kill both the Twin Metals and the PolyMet projects or the Public Utilities Commission and the Dayton-Rothman Commerce Department, it’s clear that the DFL is openly hostile to major infrastructure projects.

It’s long past time to get the PUC out of the public safety/transportation business. Similarly, it’s time to get the Commerce Department out of the environmental regulatory industry. Public safety and transportation belong in MnDOT’s purview, not the PUC’s. Environmental regulations need to be significantly streamlined, then shipped over to the DNR. There should be a period for fact-finding and public comment. There should be the submitting and approval/disapproval of an Environmental Impact Statement and the submitting and approval/disapproval of an Economic Impact Statement.

Further, laws should be changed so that there’s no longer a requirement to submit an application for a “certificate of need.” In effect, that’s a bureaucratic regulatory veto of major infrastructure projects. That isn’t acceptable. There should be a time limit placed on the bureaucrats, too. They should have to accept or reject applications within a reasonable period of time. That’s because regulators have sometimes used delaying tactics to throttle projects without leaving a paper trail. It’s also been used to deny companies the right to appeal rulings. (If there isn’t a ruling, there isn’t an appeal.)

Third, streamlining the review process limits the opportunities for environmental activists to kill projects like those mentioned above. There’s a reason why it’s called the Commerce Department, not the Department of Endless Delays and Excessive Costs, which is what it’s become. Eliminating the PUC’s oversight responsibilities, especially in terms of approving certificates of need, will eliminate the impact that environmental activists serving on that Board can have in killing or at least delaying major infrastructure projects.

Fourth, it’s important that we bring clarity and consistency to this state’s regulatory regime. The system Minnesota has now breeds uncertainty. That steals jobs from Minnesota because companies attempt to avoid Minnesota entirely whenever possible. While we want to preserve our lakes, rivers and streams, we want to preserve our middle class, too. The environment shouldn’t be put on a pedestal while communities die thanks to a dying middle class.

I’ve seen too often how once-proud parts of Minnesota that have a heavy regulatory burden have seen their middle class essentially disappear. Cities like Virginia and Eveleth come to mind. It’s immoral to give a Twin Cities agency the authority to kill Iron Range communities. That’s literally what’s happening right now.

For the last 7 years, Gov. Dayton has run an administration that’s of, by and for the environmental activist wing of the DFL. If you work in a construction union, you haven’t had a great run. That isn’t right. People who work hard and play by the rules should be able to put a roof over their family’s head, set money aside for their kids’ college education and save for their retirement. For far too many people, that hasn’t happened recently.

The next Republican governor should implement these changes ASAP. It’s time to destroy the Dayton ‘Hostile to business’ sign and replace it with an ‘Open for business’ sign. It’s time to get Minnesota government working for everyone once again.

Technorati: Mark Dayton, Public Utilities Commission, Mike Rothman, Environmental Activists, Certificate of Need, Special Interests, Regulatory Regime, DFL, Infrastructure, Sandpiper Pipeline Project, Enbridge Line 3 Pipeline, Construction Unions, Transportation, Public Safety, Republicans

This op-ed is a fantastic illustration of what DFL regulatory corruption looks like. Every voter in Minnesota should understand what’s happening by DFL special interest groups in the hope of killing mining.

In the op-ed, Steve Giorgi, the executive director of the Range Association of Municipalities & Schools, aka RAMS, wrote “Commissioner John Linc Stine and his staff at the Minnesota Pollution Control Agency (MPCA) announced this week that they will commence with rulemaking hearings across the state on the new proposed rules for limits on Sulfate standards to protect wild rice.” Later in the op-ed, Giorgi wrote “During the last legislative session, Rep. Rob Ecklund was successful in passing legislation that delayed the implementation of any new wild rice/sulfate standards until January of 2019, allowing the MPCA and all Minnesotans to get the results of a study being conducted on the cost implications of a new standard and enforcement of that standard.”

This is what a corrupt regulatory system looks like. The business getting regulated has no assurance that they’ll get the required permits if they follow the stated procedures. (Whatever happened to Bill Clinton’s saying that “if you work hard and play by the rules, you’ll be rewarded with a good life for yourself and a better chance for your children“?) Based on the Dayton administration’s actions, the hard-working people of the Iron Range will get shafted even if they work hard and play by the rules. Then there’s this:

Finding funding for $5 to $10 million dollar treatment plant expansions, along with increased annual operating costs, and then the nightmare of trying to dispose of the brine that is produced by the reverse osmosis treatment, will put most small communities into bankruptcy.

At what point will this DFL administration admit that the regulations they’re thinking about will bankrupt the state? The law was passed and signed into law. PolyMet will be forced by law into playing by the rules. Unless the metro DFL wants to just admit that they want to stop mining altogether, which they’ll deny in public but admit to in private, this regulatory system needs to be scrapped.

I’m not talking about abolishing all regulations. I’m advocating for regulations that protect the water without buying the special interests’ BS. This video is intended to present the MPCA, the regulators on the wild rice standards, as reasonable and business-friendly: That’s intentional. The key difference between the Grede project and the wild rice standards is that the special interests don’t care about Grede. They’re focused on shutting down mining.

It’s indisputable that the metro DFL, especially politicians like John Marty and Al Franken, want to prevent new mining projects from getting permitted. It’s time to throw out the current regulatory system and replace it with a system that’s both business-friendly and that protects the environment. There’s no disputing the fact that the current system is hostile to both businesses and rural Minnesota.

Technorati: Wild Rice Regulations, Mark Dayton, PolyMet, Mining, Iron Range, Special Interests, Jon Linc-Stine, MPCA, DFL, Small Businesses