Archive for the ‘DFL’ Category

Tim Walz and the DFL continue insisting upon a budget that’s best described as insane, stupid or counterproductive. The DFL’s goal, apparently, is to make Minnesota uncompetitive with other states. We’re already the highest-taxed state according to Kiplinger’s. That isn’t good enough for Tim Walz and the DFL, though. They’re pushing a $12,000,000,000 tax increase over the next 4 years.

What’s worse is that it hits the lowest incomes the hardest. That isn’t just my opinion. That’s the official summary of Gov. Walz’s Department of Revenue’s Tax Incidence Report! The latest word is that Walz and the DFL have ‘offered’ a 16-cent-a-gallon gas tax instead of a 20-cent-a-gallon gas tax. WOW! How generous. Walz and the DFL have also offered to trim $300,000,000 of spending from a $51,000,000,000 biennial budget.

If Walz and the DFL want to run on that in 2020, bring it on. That’ll be as popular as a Packer fanatic at a Vikings game. Good luck with that.

Thanks to the DFL, we’ll soon have 4 of the last 5 budget sessions ending with either a government shutdown or a contentious special session. In other words, the DFL has made governing dysfunctional again. No wonder why wealth keeps fleeing the state.

The first 6 seconds of this video of the Republicans’ press availability last night shows how determined the DFL is to overtax Minnesotans:

For instance, the budget surplus from the November forecast is over $1,000,000,000. Additionally, the year-to-date additional surplus is $573,000,000, which is 3.1% above forecast, including $489,000,000 in unexpected revenues in April, 2019. That’s before factoring in $2,523,000,000 in Minnesota’s Rainy Day Fund. That’s a record amount in the Rainy Day Fund, BTW.

What’s obscene about that is that that’s money stolen from Minnesotans who would otherwise use that money to create jobs. Instead, the DFL has confiscated that wealth to protect government. That’s how not to govern.

Republicans should stand their ground. Period. This isn’t just a budget fight. It’s a fight to restore sanity to the budget. At no point has the DFL offered reforms to fix the problems that’ve been identified by various OLA audit reports.

In summary, the DFL is gaining the reputation of spending recklessly and ignoring existing problems. Let’s see them run on that in 2020.

For the past month, Democrats have talked the Trump/GOP economy down, saying that it’s only helping the richest 1%. That’s been debunked thoroughly but now we have proof thanks to Brian Bakst’s article on Minnesota’s oversized surplus.

In his article, Mr. Bakst reports “Minnesota tax collections soared well past expectations for April, according to a tally released Friday. The Department of Minnesota Management and Budget reported revenue that was $489 million above what had been projected to come in. The excess is 17 percent above expectations for the month. April is when most income tax payments are made, so this update is more pivotal than others.”

This is vitally important for several reasons. First, it’s proof that President Trump’s policies are working. Exceeding expectations by 17% in the biggest collection month of the year is a big deal. Next, it’s a death blow to Gov. Walz’s and the DFL’s tax increases. With the economy growing in spite of Gov. Dayton’s and the DFL’s policies, it’s safe to say that we don’t need another $12,000,000,000 in tax increases.

We’re already running a $1,000,000,000+ surplus. Minnesota’s Rainy Day Fund has $2,500,000,000 in it. With the economy roaring, why should Minnesota plan on a downturn or recession? That’s as stupid as moving to Hawaii and bringing your winter parka from Minnesota.

The question for Gov. Walz and the DFL now is whether they want to spend Minnesota into oblivion or whether they’re willing to act like adults for a change. At this point, I’m not sure whether the DFL’s special interests will win out or whether the people of Minnesota will win out.

What I’m certain of, though, is that the GOP is consistently aligning with the people of Minnesota. That’s a stark contrast with Gov. Walz and the DFL.

We’re finally in the last part of the Legislature’s regular session. Apparently, we’re steaming towards the biennial stalemate otherwise known as the budget special session. Unlike other years, this isn’t just about budget numbers. This time, it’s about the direction of the state of Minnesota, both economically and politically. It’s about whether Minnesotans side with the DFL and financial unsustainability or with the MNGOP and financial stability.

The DFL, led by Gov. Walz, has picked historic tax increases (again) and unsustainable spending. If Walz and the DFL get their way, the state will spend $83,000,000,000 for all revenues spending this biennium, with $51,000,000,000 in general revenue spending. Special thanks go to Harold Hamilton and the Minnesota Watchdog for highlighting the fact that “As recently as 2001, the state spent $37 billion in that biennium. This biennium will see all funds spending of $83 billion.”

That’s far beyond ridiculous. That’s irresponsible in the extreme on the part of the DFL. Mr. Hamilton highlights this important fact:

Capital is Mobile – And it Will Flee.

When taxes are too high, taxpayers will flee to lower taxed jurisdictions. This is especially true for higher net worth taxpayers, who generally have the resources and sophistication to engage in careful tax planning. High tax states are falling into a fiscal death spiral as they raise taxes to cover more and more spending while at the same time fewer and fewer taxpayers remain to shoulder the burden.

Isn’t it interesting that Gov. Walz’s Department of Revenue did their tax incident report, which showed that the lowest income people will get hit hardest by Gov. Walz’s and the DFL’s $12,000,000,000 tax increase over the next 4 years? That’s just starting the bad news. Hamilton continues:

Every reputable organization that analyzes tax burdens ranks Minnesota among the least tax-friendly states in the nation. With respect to overall tax burden, Minnesota is in the top 5 of every reputable ranking, including being the dubious distinction of #1 overall in Kiplinger’s rankings.

No matter the metric, Minnesota punishes its taxpayers. Kiplinger’s also ranked Minnesota as the least friendly state in the nation for retiree income. For example, it’s one of the few states in the nation to tax Social Security income. Add to that high estate taxes, and retirees have little reason to live here, other than the magnificent weather. The North Star state also has a nasty reputation for punitive taxes on the working poor through high regressive taxes.

Here’s the latest on negotiations:

Just before 7 p.m., the Democrats and Republicans met with the Governor. The meeting lasted about an hour and a half. Two major budget sticking points concern Gov. Walz’s proposed 20-cent gas tax and the already in place 2% medical provider tax, which sets aside money for low-income Minnesotans for health care.

Gov. Walz said they made a budget offer last Wednesday, even cutting $400 million in spending and revenue over the next two years, but he says Republicans won’t meet them in the middle. The Governor is confident a compromise will happen soon, but he says his patience is being tested.

“It doesn’t matter if there’s a big story in southern Minnesota telling us that our transportation’s at a tipping point and every single county commissioner and city manager and civil engineer was interviewed for it and said, ‘Yeah, we got to do something or this can be catastrophic,’ and yet we’re still hearing no,” Gov. Walz said. “So yeah, my frustration level is growing.”

First, there’s virtually no support for the gas tax increase. I mean, less than 20% of Minnesotans support a gas tax increase. Further, we learned this week that revenue collection for April was almost $500,000,000 over expectations, meaning we’d have a surplus for this biennium of over $1,500,000,000. If you add into that the fact that there’s over $2,500,000,000 in Minnesota’s Rainy Day Fund, there’s really no reason for any tax increases.

It’s time for Gov. Walz and the DFL to fold their tent and return to Realityville. God only knows where they’re at right now. I’m betting the DFL is inhabiting another solar system.

Friday, I received Dan Wolgamott’s weekly e-letter update. The subject of this week’s e-letter update was the budget. Wolgamott and the DFL are touting their ‘investment’ in education rather than talking about the DFL’s $12,000,000,000 tax increase over the next 4 years:

For more on the House’s Minnesota Values Budget, you can read about the innovations and investments we’re making in health care, education, transportation, and taxes here. These aren’t gimmicks or quick fixes to complicated issues. We’ve made smart, steady investments that are backed up by the values Minnesotans hold dear, and I hope you’ll join me in urging my Senate colleagues to work with us in a way that moves Minnesota forward, not back.

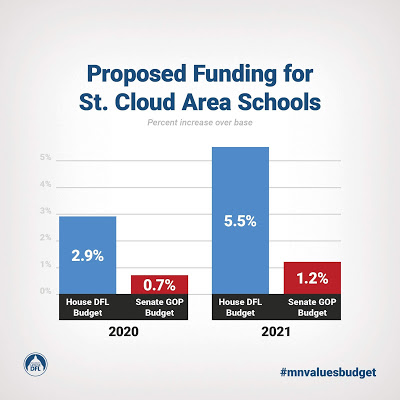

I’m sure it’s purely accidental (not!) that this is the only informational graphic in the e-letter update:

It doesn’t take a rocket scientist to figure out that Wolgamott doesn’t want to be known for the huge tax increases he’s voted for. Zach Dorholt became famous for voting for the DFL’s huge tax increases in 2013. He was defeated in 2014. Wolgamott is a career politician wannabe serving his first term. He wants to last longer than Dorholt. That’s why he’s downplaying the tax hikes that would make Minnesota unattractive to businesses if they went into effect.

Then there’s this:

This highlights just one of several areas where the unsatisfactory investments made in the Senate don’t even come close closing the education funding gap that hurts our schools and students. Our education proposal in the House is the product of input from students, parents, teachers, and administrators. We’re funding our schools based on conversations we’ve had at Town Halls like the ones I’ve held in St. Cloud. This is your budget, and I’ll continue to fight for the investments that you deserve.

Unfortunately for his constituents, he’ll fight hardest for the biggest tax increases in state history. What’s worst is that the DFL’s tax increases hit the lowest 25% of income earners the hardest of all income groups:

The tax plan proposed by Gov. Tim Walz would hit lower income Minnesotans harder than wealthier earners. That’s the outcome of analysis by the Democratic governor’s own Department of Revenue, which carried out a tax incidence analysis of Walz’s plan, which includes, among other things, a reduction in state income taxes but increases in business, estate, gas and vehicle sales tax, among other changes.

According to the revenue department, the overall tax burden on Minnesotans would increase from 11.63 percent currently to 12.39 percent under Walz’s plan, an increase of 0.76 percent. However it’s the lowest earners who would see a bigger increase in their taxes.

That’s what Dan Wolgamott and the DFL are fighting for. They aren’t fighting for students. They’re fighting for Education Minnesota and other DFL special interest groups. Tim Walz’s and the DFL’s profligate spending aren’t investing in the future. They’re pushing productive Minnesotans to other states.

Finally, Rep. Wolgamott and the DFL are making Minnesota more uncompetitive. The DFL couldn’t do much more to push businesses away except putting a sign on each entrance to the state saying ‘Businesses aren’t welcome here.’

If you haven’t paid attention to the legislature this session, you’ve undoubtedly save yourself a ton of aggravation. The DFL House and DFL Gov. Tim Walz insist on a) turning Minnesota into a cold California and b) spending Minnesota into oblivion. Simply put, these people are beyond nuts!!!

The Minnesota Watchdog’s Quote of the Week is from Sen. Michelle Benson (R – Ham Lake). She said “Between 2016 and 2023 our state budget is forecast to grow $11.5 billion. The Governor and House want to add $12 billion in new spending.”

Harold Hamilton, the man responsible for putting the weekly commentary, noted “In addition to limits on taxation, there are limits on spending. The state is on an unsustainable trajectory, with a day of reckoning coming because taxes simply can’t be raised high enough to support DFL spending desires. Last week’s edition showed the massive and exponential growth of the state’s ‘all funds’ spending over the past 50 years. This growth has far exceeded population growth and inflation over time.

“As recently as 2001, the state spent $37 billion in that biennium. This biennium will see all funds spending of $83 billion.”

This isn’t negotiating a budget. It’s about determining whether we want to chase the rest of the productive people out of Minnesota. Hamilton continues:

High tax states are falling into a fiscal death spiral as they raise taxes to cover more and more spending while at the same time fewer and fewer taxpayers remain to shoulder the burden. Connecticut is the poster child for this liber-induced fiscal death spiral. New York is becoming so. Recent changes to the federal tax code limited the deductibility of state taxes, which was essentially a federal subsidy for wealthy people living in those high-tax states. Both tax and real estate data are showing that wealth New Yorkers are leaving the state and establishing domicile in tax friendly jurisdictions like Florida.

It’s time to kick these DFL idiots out of the legislature in huge numbers. It’s essential to establish, at minimum, conservative supermajorities in the House and Senate so we can thwart the DFL’s plans. If we don’t defeat these idiots, Minnesota will drift quickly into economic oblivion.

It’s insulting to hear DFL legislators and Democrat Gov. Tim Walz complain that Republicans hadn’t moved from their position of being unwilling to raise Minnesota’s taxpayers burden by $12,000,000,000 over the next 4 years. According to this AP article, the DFL expected GOP lawmakers to accept that $12,000,000,000 tax increase in exchange for the DFL cutting $332,000,000 out of the DFL’s $50,000,000,000 budget.

That isn’t a compromise. That’s a total capitulation if it happened. Thankfully, it won’t happen. That’s because the GOP majority in the Senate won’t budge on these (or any other) tax increases.

Minnesota’s tax and regulatory system has already made it one of the least competitive states in the US. According to Walz’s own Department of Revenue report, the Walz-DFL monster tax increases promise to hit lower income taxpayers the hardest:

The tax plan proposed by Gov. Tim Walz would hit lower income Minnesotans harder than wealthier earners. That’s the outcome of analysis by the Democratic governor’s own Department of Revenue, which carried out a tax incidence analysis of Walz’s plan, which includes, among other things, a reduction in state income taxes but increases in business, estate, gas and vehicle sales tax, among other changes.

According to the revenue department, the overall tax burden on Minnesotans would increase from 11.63 percent currently to 12.39 percent under Walz’s plan, an increase of 0.76 percent. However it’s the lowest earners who would see a bigger increase in their taxes.

The so-called Party of the Little Guy wants to soak the little guy? That fits the DFL’s identity since the DFL seems to think that President Trump’s broad-based recovery is only being felt by millionaires and billionaires, not the blue collar workers that’ve experienced a 4.5% growth in wages compared with the 1% seeing a 3% increase in wages:

The governor said in an interview on Minnesota Public Radio that his budget was based on what the state needs to spend to maintain quality education and other programs at a time when the state’s population is growing, and that he’d like to see some reciprocity from Republicans.

That’s BS! Minnesota doesn’t need to become less competitive taxwise. Republicans’ campaign slogan should be ‘Make Minnesota competitive again.’ There isn’t a polite way to put this so I’ll just say it. Tim Walz and Melissa Hortman are economic illiterates. Walz was a nobody in Washington, DC. Hortman’s list of accomplishments is shorter than Barack Obama’s.

If the DFL keeps insisting on their massive tax increases, Hortman will be a 1-term speaker and Republicans will gain seats in the Senate, too. These tax increases are, to put it politely, counterproductive. The DFL should be sued for economic malpractice.

This article highlights a DFL ‘tradition’ of taking credit for cleaning up a mess that they created. When DFL Gov. Walz started filling out his cabinet, he picked Mark Phillips to be the Commissioner of the Department of Iron Range Resources and Rehabilitation. Then Phillips hired Joe Radinovich, the DFL congressional candidate for CD-8 in 2018, to a cushy political patronage job on the IRRRB that would’ve paid Radinovich a $100,000 annual salary.

Enter our fearless hero, Gov. Walz, to deliver a tongue-lashing for the ages. Gov. Walz said “I expect you to model openness, transparency, inclusivity and servant leadership. In this situation, you fell far short of my expectations.”

Gov. Walz, you fell far short of our expectations. How dare you appoint a commissioner that’s that corrupt. How dare you not do your due diligence before picking a commissioner to lead a board known for its corruption. This article highlights one instance of IRRRB corruption:

It’s an issue we’ve raised before, as recently as last year. The principle of the separation of powers that guides our government at both the state and federal levels, would appear to prohibit the structure now in place at the IRRRB, where a board comprised primarily of sitting legislators has authority over an executive branch agency. The legislative auditor, in his report this past week, agreed that the current makeup of the board leaves the agency vulnerable to a court challenge on constitutional grounds.

But the makeup of the current board raises other concerns beyond a simple legal dispute. By giving local legislators control of the purse strings for millions of dollars in funding for community and economic development projects within the Taconite Relief Area, the IRRRB helps to cement the status quo rather than encourage new ideas and leadership at a time when alternative visions are definitely needed. As we’ve noted before, giving Iron Range legislators outsized political clout tends to stifle dissenting voices from other elected officials in our region for fear that projects in their communities will be denied funds. There are reasons why the political class on the Iron Range marches in virtual lockstep to the agenda of the region’s legislators, and their control over IRRRB funds is certainly one of the most powerful.

This ‘arrangement’ put legislators in charge of both the appropriations process in the legislature and the handing out of loans from the IRRRB. It’s unconstitutional to be a member of the executive branch and the legislative branch.

Had Gov. Walz paid attention to details like that, we wouldn’t have had these problems. Gov. Walz, this is as much your fault for not paying attention to the people you hired as it is Commissioner Phillips’ fault for not prioritizing integrity in the hiring process.

It’s safe to say that the DFL House majority isn’t interested in keeping Minnesota competitive with other states. This DFL majority is intent on raising a whole host of taxes. This AP article highlights the latest DFL partisan vote to raise taxes.

It says “The 74-58 vote on the $7.2 billion package fell mostly along party lines. Majority Democrats stressed during several hours of debate that began Friday the need for a stable, dedicated source of revenue to make badly needed road and bridge improvements. Their proposal would raise the gas tax by a nickel per year for four years for a 70% total increase from the current tax of 28.5 cents per gallon.”

Later, the hammer dropped:

Minority Republicans countered that the state already has plenty of money to spend on transportation from existing revenue streams and a projected $1 billion budget surplus. They also pointed to a recent Department of Revenue analysis that found the tax increase would fall hardest on low- and middle-income residents, and said it would make driving more expensive for all Minnesota motorists.

Of course, Dan Wolgamott, my DFL representative, voted the way he was told by DFL Speaker Melissa Hortman told him to. Thus far in his brief legislative career, Wolgamott has voted for billions of dollars of tax increases. It’s apparent that Wolgamott, like his DFL puppet masters, intend on hurting taxpayers. It’s clear that the DFL views taxpayers as ATM machines.

There’s an old saying about how differently Republicans and see the world. It’s said that Democrats see every day as April 15th while Republicans see each day as the 4th of July. This article does nothing to dispel that perspective.

I’m not surprised that the DFL House wants to raise taxes again. After reading this article, though, I’m getting a bit upset that they think taxpayers are just their personal ATMs.

Republicans in the House better vote unanimously against these tax increases:

Democrats in the Minnesota House proposed a tax bill Monday that would raise $1.2 billion in new revenue, largely from big business. DFL leaders stressed that the money is needed for education, health care and other new spending plans. But Senate Republicans oppose the tax increases and are digging in for the fight ahead.

House Speaker Melissa Hortman, DFL-Brooklyn Park, said public schools have been underfunded due to Republican-backed tax policies, including recent federal changes, that she believes favor the rich. “Tax cuts for the wealthy and corporations have exploded income inequality, and our tax bill works to restore some fairness,” she said.

I’m sure there’s a polite way of putting this but I won’t say this politely. Thanks to the DFL’s tax policies, Minnesota is no longer competitive.

When Gov. Walz told us that the state of the state is strong, he lied through his teeth. That’s BS. People of all age and income groups are leaving Minnesota. They aren’t just leaving for retirement. They’re leaving because the DFL has run the state’s economy into the ground. Why would people start or expand businesses knowing that they’ll have targets painted on their backs virtually immediately?

This is the chief thief this time:

It’s time to fire her in 2020.

This Vanity Fair article asks if Republicans can turn AOC into 2020 Kryptonite. It’s a fair question but it’s short-sighted. AOC is the brightest star in the Democrat galaxy at the moment but she’s far from being the only bright star that Republicans can weaponize.

Anyone that thinks that Republicans won’t weaponize Ilhan Omar is kidding themselves. And trust me, once they put together a ‘greatest hits clip of Rep. Omar, including this one, the nation will know that Democrats aren’t the moderates that they claimed to be:

That’s before Republicans weaponize Sen. Schumer and Nancy Pelosi. Trust me when I say that Democrats won’t understand what hit them. Right now, they’re confident that their ideas are winning the day. The media is siding with them virtually all the time, too. Pelosi has played a couple issues to her favor. What she didn’t do is side with the American people on important things. She’ll be exposed on that soon enough.

What Democrats haven’t figured out is that the nation actually wants to be safe. Democrats aren’t providing that. When Pelosi and Schumer file the lawsuits against President Trump’s wall, everyone will know that Democrats don’t give a damn about border security. Anyone thinking that Democrats care about anything other than replacing blue collar workers is dumber than AOC.